Expanding Broker Options: QuickFacts Introduces High Value Insurance Comparisons

At QuickFacts, innovation is in our DNA. We’re thrilled to announce the expansion of our Comparisons product to now include High Value Retail options in addition to our Personal Lines Retail Comparisons. In a world where protecting what matters most is key, we’re focused on creating solutions that give time back to brokerages, allowing them to focus on the unique needs of their clients.

What is High Value Insurance?

It is important to grasp the difference between standard retail insurance and high-value coverage, as they cater to distinctly different needs and will be presented separately on our comparisons platform.

High-value insurance goes beyond ordinary coverage offering specialized protection for high-value assets. These clients have unique needs compared to regular clients, often involving more exposure to liability and requiring coverage for items that a standard homeowner’s policy does not address such as homes, antiques, jewelry, collectibles, vehicles, boats, and wine collections, among others.

Additionally, the high-value insurance market is more complex; the underwriting process is more involved and time-consuming, with less information readily available to brokers, since documentation is handled in a significantly different manner than in retail insurance. This complexity and the need for meticulous coverage can be intimidating for new brokers, who must ensure that all potential exposures are comprehensively covered for their high-value clients.

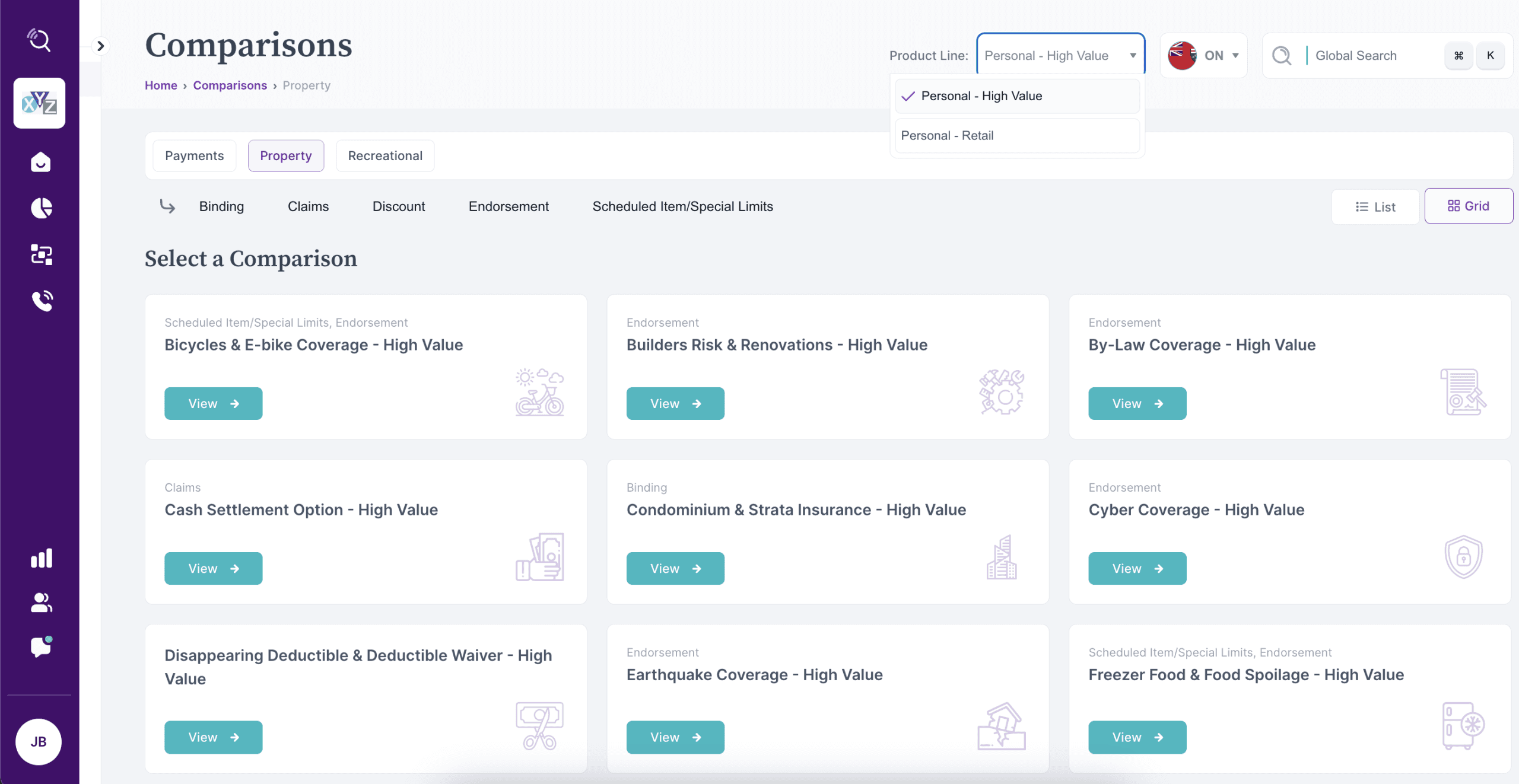

QuickFacts’ Product Line Selector

To distinguish between personal Retail and High Value Retail, we have introduced a product line selector on our platform so our clients can easily toggle between products. By offering a seamless experience that distinguishes between these two options, we empower brokers to make informed decisions that align with their client’s unique requirements.

We have 40 different coverage comparisons specific to High Value clients with links to all applicable forms, wordings, manuals, and other documents needed to handle these clients quickly.

Recognizing the Gap

Brokers face a multitude of challenges when catering to High Value clients. The underwriting process is complex and can often create confusion and inefficiencies. At QuickFacts, we identified this gap and took proactive steps to bridge it. By extracting and compiling all relevant High Value underwriting information, we equip brokers with a comprehensive overview at their fingertips. This streamlined approach not only simplifies the underwriting process but also boosts brokers’ confidence, ensuring they can deliver exceptional service efficiently.

Through collaboration with industry experts and listening closely to the feedback of our brokerage partners, we’ve developed a solution that enhances the overall experience of clients, as their broker saves significant time using QuickFacts. With over 55% of our brokerage partners currently handling High Value clientele, we understand the importance of providing tailored solutions that meet the demands of today’s market. Our commitment to continuous improvement drives us to evolve and adapt to the ever-changing landscape of the insurance industry.

Leveraging QuickFacts

Ready to explore the possibilities with QuickFacts? Book a demo today to discover how our Comparisons software can save your brokerage thousands of hours and increase revenue. Gain access to High Value carrier comparisons and elevate your quality of service to new heights. Empower your team, delight your clients, and stay ahead of the competition with QuickFacts.